Introduction

In 2018, a reform of the ISF wealth tax, promised by President Emmanuel Macron during his election campaign, came into effect. The rationale behind the new tax system is to attract entrepreneurs to invest in French companies and to bring back tax exiles who were previously heavily taxed by the ISF.

The annual ISF wealth tax has been transformed into the IFI real estate wealth tax (L’Impôt sur la Fortune Immobilière, IFI). The new tax is limited to real estate that is not related to the taxpayer's business activities. Financial assets, company shares (except those holding real estate), securities, savings, and movable property are excluded from the taxable base of the new tax. Taxpayers subject to the IFI are individuals whose real estate assets, either in full ownership or usufruct, exceed 1.3 million euros as of January 1 of the current year. The applicable tax rate remains unchanged, ranging from 0.5% to 1.5%.

What are the Tax Conditions for IFI?

Individuals who are tax residents of France, and whose net worth of real estate assets exceeds 1.3 million euros as of January 1 of the tax year, are subject to the IFI tax. This tax applies to all their real estate, whether it is located in France or abroad, with the exception of international tax agreements for properties abroad (see tax conventions with each country separately to avoid double taxation).

Individuals who are residents of another country are also liable for the IFI tax on all their property located in France if its total net value is equal to or greater than 1.3 million euros.

Individuals becoming tax residents of France, who were domiciled abroad for the previous five calendar years, are temporarily taxed under IFI only on their property in France. This temporary measure applies for 5 years after relocating to France. It should be noted that taxpayers who have already utilized this measure under the former ISF tax must continue under IFI until the completion of the 5 years.

Who Pays the IFI Wealth Tax?

The wealth tax applies only to individuals and their families. To determine whether you have reached the tax threshold for paying the IFI tax, you must sum up all real estate assets owned by each member of your tax household as of January 1 of the current year.

Joint taxation under the IFI tax applies to:

- Married couples, regardless of their matrimonial regime;

- Civil solidarity pact (PACS) partners;

- Unmarried cohabiting couples.

The property of minor children is taxed together with their parents' property. If a child turns 18 years old on January 1 of the current year, their real estate property no longer forms part of the taxable property of the parents, even if the child is attached to the family for income tax purposes.

However, having separate declarations can be more advantageous: this way, the tax base is calculated separately for each individual, and it is more likely to avoid the IFI tax. To declare the wealth tax separately for spouses, two conditions must be met:

- The spouses must be married under a regime of separation of property.

- The spouses must live separately, meaning each spouse must have a separate home address (for example, a case where one spouse is engaged in professional activity abroad, thus necessitating another place of residence).

For couples planning to divorce, as well as for those not married under a regime of separation of property, a joint declaration is mandatory, except if a judge officially authorizes the couple to live separately as of January 1. Simply desiring to dissolve the relationship by one of the spouses does not constitute grounds for changing the mode of declaration for the IFI tax.

What is Subject to IFI Taxation?

All real estate, as well as shares in companies or organizations owning real estate, are subject to IFI taxation. It's essential to consider both built and unbuilt properties, regardless of their future use:

- Built structures (for personal use or rented out): houses, apartments, and their ancillary buildings (garage, parking, basement, etc.);

- Buildings classified as historical monuments;

- Buildings under construction as of January 1 of the tax year;

- Unbuilt properties (land for construction, agricultural land).

Exempt from IFI taxation are assets used for individual or collective entrepreneurship and professional activities (industrial, commercial, artisanal, agricultural, or liberal professions).

How is Property Valued for IFI Taxation?

Taxable properties are assessed at their market value as of January 1 of the tax year, in other words, at the price the owner could sell the property on that date.

There are specific valuation rules for different types of property, for example:

- For the main residence, a 30% discount is applied;

- Property rented out may have a tax reduction ranging from 10 to 40%, depending on the type of rental contract (unfurnished, furnished, commercial rent);

- The value of property under construction as of January 1 is assessed based on its state of completion on that date;

- The taxable value for usufruct rights is equated to 100% ownership of the property, with some exceptions.

Property valuation can be based on comparable properties in the market or on sales of similar properties made in recent years. In the first case, one can independently review market offerings or seek assistance from a real estate agency. The agent will provide an opinion, but the document issued will not be an official assessment. In the second case, valuation based on sales can be obtained from the official website of the tax administration in the PATRIM section or from a notary.

The most prudent method of valuation is considered to be hiring an expert, though this entails some 'useful' expenses. The expert will provide a real assessment with a detailed report, starting at 500 euros. In this case, the expert defends the conclusions of their report against the tax authorities if they contest the declared amount. The choice should be made for a real estate specialist who has special professional insurance for their expert activity. This insurance can compensate the owner in case the property valuation turns out to be inaccurate and the tax administration imposes fines. In any case, it is useful for the owner to have an official document with the valuation, even if they believe they are not subject to IFI taxation. If tax authorities later request information, the owner can justify the chosen valuation by preparing an expert report.

What Constitutes a Liability for IFI?

The IFI tax rate is applied to the net value of the property after deducting all documented liabilities existing as of January 1 of the calendar year. It is permissible to deduct liabilities related only to the taxable asset. The deductible liabilities include:

- Costs associated with acquiring real estate, taxable rights on the property, and credit obligations;

- Expenses for reconstruction, modernization (improvement), construction, reconstruction, or enhancement of the property;

- Expenses related to the acquisition of shares or units, proportionate to the value of the taxable real estate and rights;

- Payment of taxes on the respective property (for example, property tax). Taxes levied on the occupant (e.g., housing tax) are not deductible. Income tax on property is also not deductible.

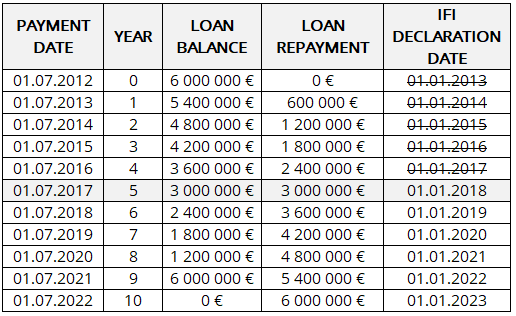

Since 2018, liabilities related to short-term IN FINE credit are not fully deductible. This credit is partially deductible, based on the principle of a classic credit over the repayment period. This means that a linear amortization of the IN FINE credit must be recreated to determine the deductible liability. For example, an IN FINE loan of 6 million euros over 10 years, after 5 years, will be deductible up to 3 million euros.

Example of Amortization Repayment of an IN FINE Loan for IFI Tax Calculation:

The owner took out an IN FINE loan for 10 years.

Date of loan issuance: 01.07.2012. Loan amount: 6 million euros.

As of 01.01.2018, according to legislation, within the framework of the IFI tax, the IN FINE loan is considered as a repayable (classic) loan over the loan term.

The loan repayment table would look as follows (see table below).

As of 01.01.2018, the loan liability is 3 million euros. The following year, the liability will be 2.4 million euros.

Liabilities associated with perpetual (undated) loans can be deducted considering an amortization repayment over 20 years.

Excluded from deductions are debts contracted with a member of your tax household within the framework of IFI or with other relatives (descendants), brothers, or sisters, unless you can prove the normal nature of the loan terms (amount, adherence to repayment deadlines, and other credit repayment obligations).

As of January 1, 2018, a 'ceiling' has been introduced for deductible liabilities when the market value of taxable assets exceeds 5 million euros. The amount of deductible debts exceeding 60% of the value of taxable assets is reduced by half.

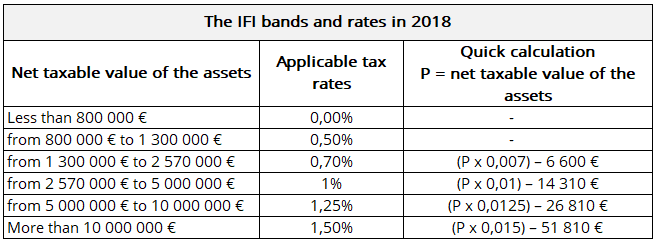

How is the IFI Tax Calculated?

The tax is calculated as a percentage on a progressive scale ranging from 0.5% to 1.5%. The net value of the property (after deducting documented expenses) exceeding 1.3 million euros is subject to tax from 800,000 euros.

Example of IFI Wealth Tax Calculation: The net value of real estate is 6 million euros.

Using the IFI tax calculation table, the calculation is as follows:

(1,300,000 - 800,000) x 0.5% = 2,500

(2,570,000 - 1,300,000) x 0.7% = 8,890

(5,000,000 - 2,570,000) x 1% = 24,300

(6,000,000 - 5,000,000) x 1.25% = 12,500

In total, the IFI tax to be paid will amount to 48,190 euros (2,500 + 8,890 + 24,300 + 12,500).

Alternatively, the tax can be calculated using the quick calculation formula.

For this case, where the net value of real estate is 6 million euros, the applicable formula will be:

(P x 0.0125) - 26,810 €

In total, the IFI tax to be paid will be (6,000,000 x 0.0125) - 26,810 € = 48,190 €.

When and How to Declare for IFI?

If the net value of the property subject to IFI tax exceeds 1.3 million euros on January 1st of the calendar year, you must file an annual IFI declaration.

The deadline for filing declarations for all, including non-residents, is between April and June, depending on whether you are filing the declaration online or in paper format.

Non-residents with income from a French source must provide information about IFI at the same time as their income tax. Residents of Monaco must submit their IFI declaration to the Tax Office in Menton.

When filing the IFI declaration, there is no need to calculate the tax and make the payment yourself. The amount of IFI payable will be communicated through a separate notice in August of the current year, and the payment must be made no later than September 15th of the same year.

This article is based on tax information from 2018.