Getting mortgage in France and Monaco

Embarking on your journey to finance a dream property in France and Monaco, be it a serene villa in the Cote d'Azur or a chic apartment in bustling Monaco, begins with an understanding of the diverse mortgage options available. The French Riviera property finance market caters to a broad spectrum of real estate investments, each with its unique financing needs.

The array of mortgages in France and Monaco is designed to suit various buyer profiles. A pivotal aspect of this process is understanding the deposit or Loan to Value (LTV) ratios. The LTV ratio is a financial term used by lenders to express the ratio of a loan to the value of an asset purchased. It is calculated by dividing the amount of the loan by the value of the property, then multiplying by 100 to get a percentage. Typically, LTV ratios in France can range from 70% to 80% for most borrowers, meaning you would need a deposit of 20% to 30% of the property's value. For instance, if a property is worth € 1 000 000 and the loan amount is €700 000, the LTV ratio would be 70%. However, for non-EU residents, this requirement might be higher, often up to 50%, due to the increased perceived risk.

The maximum loan term usually spans up to 25 years and can extend to 27 years in some cases. The debt-to-income ratio, crucial for assessing your ability to manage payments, is capped at 35% of your total net income. This cap, established by the HCSF (High Council for Financial Stability) since January 2022, applies across all borrower categories.

Age limits are also a key consideration, with most French lenders setting the age threshold for the end of the mortgage term around 70 to 75 years. This means the borrower's age plus the mortgage term should not exceed this limit.

French banks may grant exemptions for a portion of their loans, often focusing on financing main homes and favoring first-time home buyers, in line with their commitment to a sustainable and equitable property financing environment.

Types of mortgage and rates

A fixed-rate mortgage (FR: Prêt à Taux Fixe)

A fixed-rate mortgage, known for offering a constant interest rate throughout the repayment period, is a popular choice for its reliability and predictability. Borrowers particularly value this type of mortgage for the assurance it provides; the monthly payments and the total loan cost are established from the start, eliminating any concerns about rate fluctuations due to market trends. This stability makes it an attractive option, especially in the luxury real estate finance sector in areas like the Cote d'Azur, which often focuses on long-term property value and sustainability. However, recent years have seen changes in the mortgage market. Traditionally, France has maintained some of the lowest mortgage rates in Europe, but the global energy crisis of 2022 had a significant impact. For the first time since 2012, the average annual fixed mortgage rate surpassed 3% in April 2023, escalating up to 4.5% for 20-year loans by June 2023, a sharp increase from the average rate of 1.5-2% until March 2022. This rise, which has led to monthly rate revisions in 2023, is attributed to the broader economic challenges faced by the French economy. Despite this uptick, French mortgage rates remain relatively low compared to other countries, with future trends likely influenced by global economic conditions and domestic policy responses.

A variable-rate mortgage (FR: Prêt à Taux Révisable)

A variable-rate mortgage, known as 'Prêt à Taux Révisable' in French, offers a dynamic interest rate that adjusts periodically based on a financial index, typically the Euribor (Euro Interbank Offered Rate). The functioning of this type of mortgage is rooted in its alignment with the Euribor rates, either the three-month rate or the one-year rate, plus a lender's margin ranging from 1% to 3%. This margin is determined by the specifics of the loan and the borrower's profile. As Euribor rates fluctuate – usually reviewed every 3 to 6 months in line with the European Central Bank's interest rates – so too do the interest rates on these mortgages. This setup can make variable-rate mortgages initially more attractive due to their lower starting rates compared to fixed-rate mortgages. However, they also introduce an element of uncertainty, as predicting long-term market lending rates can be challenging. To mitigate this risk, these contracts often include a 'taux capé' clause, which puts a cap on how much the interest rate can change, providing a safeguard against extreme fluctuations in the rate.

For the most current Euribor rates, which are pivotal to understanding the fluctuating nature of variable-rate mortgages in France, official data can be accessed from authoritative financial sources like the Official Euribor Website.

This approach offers a blend of potential savings at times of lower interest rates and the risk of rate increases, making it a fit for borrowers who are comfortable with some level of uncertainty and are perhaps looking to capitalize on lower initial rates.

A capped variable-rate mortgage (FR: Prêt à Taux Révisable Cape)

A capped variable-rate mortgage offers a blend of fixed and variable rate features. Initially, it typically provides a lower fixed rate for the first 7-10 years, followed by a variable rate with a predetermined ceiling. This cap ensures that the rate won't exceed a certain level, balancing the stability of fixed rates with the potential savings of variable rates. Often more economical than standard fixed-rate loans, capped variable-rate mortgages are an attractive choice in markets like the French Riviera, where they offer a compromise between predictability and flexibility.

Each type of mortgage rate has its unique advantages and potential drawbacks, making it crucial for borrowers to assess their financial situation and long-term property goals before making a decision.

Mortgage loan procedure

Navigating the French mortgage process involves several critical steps from pre-approval to the final closing of the deal. Understanding this process is key, especially in the context of the French Riviera property finance market.

- Pre-Approval: The journey often begins with obtaining a pre-approval from a French bank. This step involves assessing your financial health and determining how much you can borrow. This preliminary step is crucial for gauging your budget and setting realistic expectations for your property search in France.

- Application and Documentation: Once you've identified your desired property, the next step is to fill out a French Mortgage Application. This involves submitting various documents in their original form, often requiring translation by an official translator. These documents typically include proof of income, employment details, current debt obligations, and personal identification.

- Bank's Review and Conditional Offer: The bank usually has 30 days to review your application and decide on the loan. Upon approval, the bank issues a conditional offer (offre préalable), which outlines the terms of the mortgage. This offer includes details such as the loan amount, interest rate, repayment schedule, and any other conditions tied to the loan.

- Cooling-Off Period: In compliance with French law, there is a mandatory ‘cooling off’ period of 10 days after you receive the offer. This period allows you to review the terms and make an informed decision without pressure.

- Debt-to-Income Ratio Check: French lenders are stringent about ensuring that borrowers can comfortably manage their mortgage repayments. A key aspect of this assessment is the examination of your debt-to-income ratio. This change from the previous limit of 33% to the current 35% was instituted following the guidelines set by the HCSF (High Council for Financial Stability) which became mandatory from 1 January 2022. Now, including your new mortgage, your total outgoings should not exceed 35% of your net household income. This revised threshold, regulated by the HCSF's new rules, ensures that borrowers maintain financial stability even after taking on the mortgage and aligns with the latest financial practices in the French mortgage market.

- Final Agreement and Loan Disbursement: Once you accept the mortgage offer and the cooling-off period has lapsed, the loan agreement is finalized. The loan amount is then held available for four months, allowing ample time for the completion of the property transaction.

- Closing Costs: It's important to note that certain costs associated with purchasing property, such as agency fees and notary fees, are not typically covered by the mortgage loan. These costs need to be planned for in advance as part of the overall investment.

Tax Strategies for Rental Property Investments

In fine loan (FR: Prêt in Fine)

In the context of a classic loan, borrowers typically make monthly payments that include both the borrowed capital (principal payment) and the interest. Standard capital and interest repayment mortgages, offered by lenders, can be structured as either a straight line or increasing capital repayment plus interest. These are paid off monthly over the duration of the mortgage. However, for borrowers subject to the new property wealth tax (IFI), it's important to consider the depreciation loan table when the return value of their real estate surpasses the tax IFI threshold.

The In Fine loan offers a unique approach: borrowers only reimburse the interest throughout the loan term, with the principal typically paid back in a single installment at the end. To manage this, borrowers often set up savings associated with an investment product, such as life insurance, making monthly contributions to a savings account. This way, the principal remains untouched until the final payment. During the loan In Fine period, the value of the acquired property is considered negligible for IFI wealth tax purposes, with the tax payment due only after the loan is fully repaid.

Loan optimization

Banks in France and Monaco offer various schemes to optimize loans. Placing funds in a savings deposit or investing in financial instruments can significantly reduce the loan's cost. These investments typically yield 3-4% per year on average, without special risks. The larger the deposit, the more beneficial for the client, a key consideration in luxury real estate finance.

Additional costs

Administrative fees from the bank typically range between 0.25-0.5% of the borrowed capital. An assessment of the property being purchased is often required before a mortgage decision, with costs varying from 500 to 5000 euros, depending on the property and appraisal company. Additionally, charges from a French Notaire usually amount to about 1% of the property value when registering it in a mortgage bureau.

Tax allowances

Acquiring real estate through a mortgage in France and Monaco can lead to significant tax benefits. Borrowers can substantially reduce their annual income tax on rental income by deducting the interest paid. Furthermore, it's possible to minimize or even be exempted from the wealth tax IFI by subtracting the principal from the taxable base for IFI tax calculation. This is particularly relevant for non-resident French mortgages, where understanding the nuances of tax implications is crucial for both residents and non-residents.

Example of payments on a long-term mortgage

To better understand the implications of long-term mortgages, let's consider an example with a €1,000,000 loan amount, a 10-year term, and a 3% interest rate. We'll outline what this means for annual payments and the total cost.

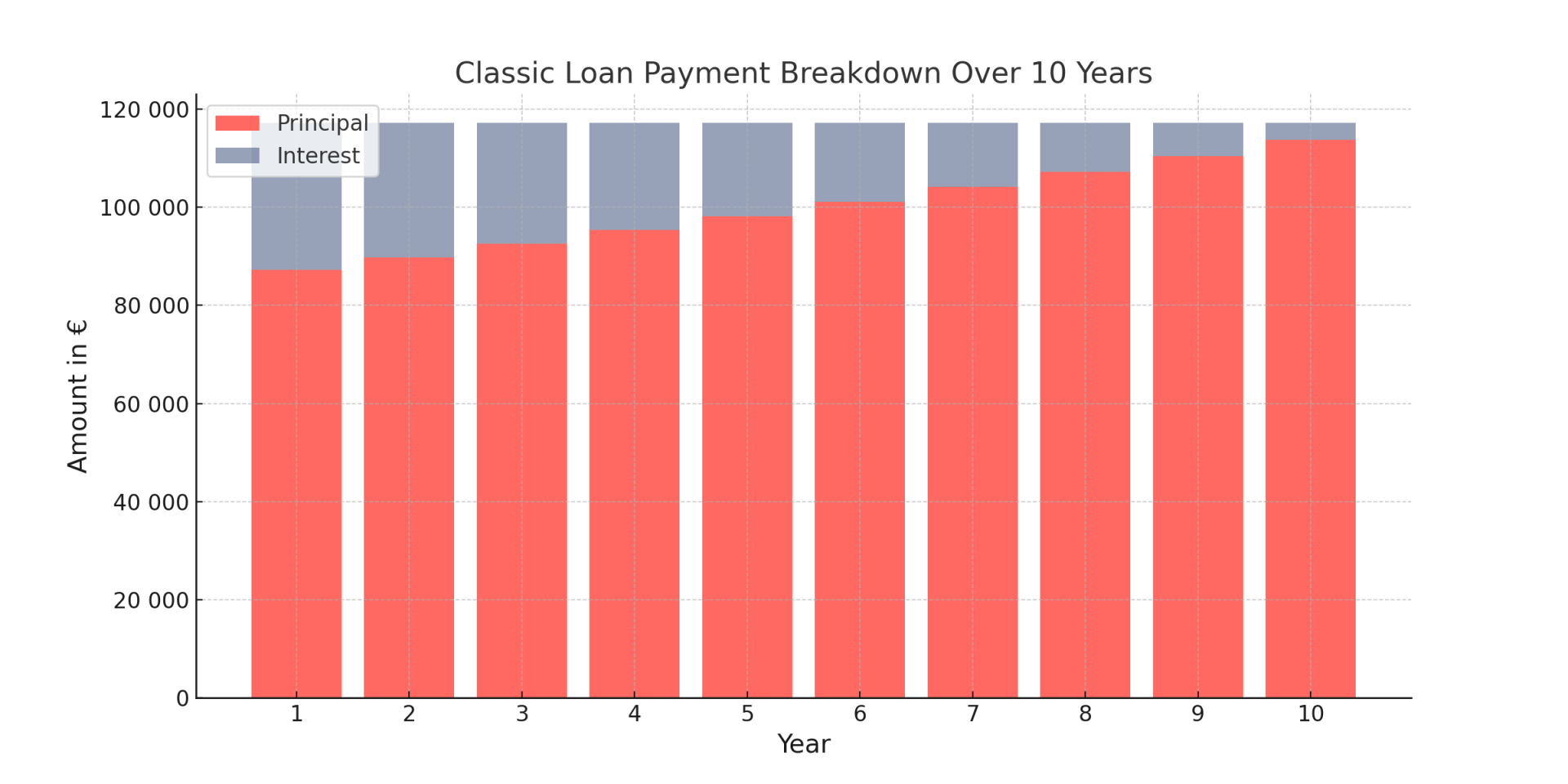

Classic loan (FR: Prêt Classique)

Each year, the borrower makes a payment that includes both interest and principal. The interest for each year is calculated on the remaining balance, which decreases as the principal is repaid. This results in a decreasing interest payment each year. The total annual payment (interest plus principal) remains the same throughout the loan term due to the amortizing nature of the loan.

The first year's interest payment would be €30,000, but this amount would decrease each subsequent year as the outstanding loan balance decreases. Consequently, the portion of the borrower's payment that goes toward the principal would increase each year.

The first year's interest payment would be €30,000, but this amount would decrease each subsequent year as the outstanding loan balance decreases. Consequently, the portion of the borrower's payment that goes toward the principal would increase each year.

The depiction shown in the plot illustrates the breakdown of principal and interest payments over the 10-year term. As seen, the interest component (in gray) decreases over time, while the principal component (in red) increases, reflecting the typical structure of an amortizing loan.

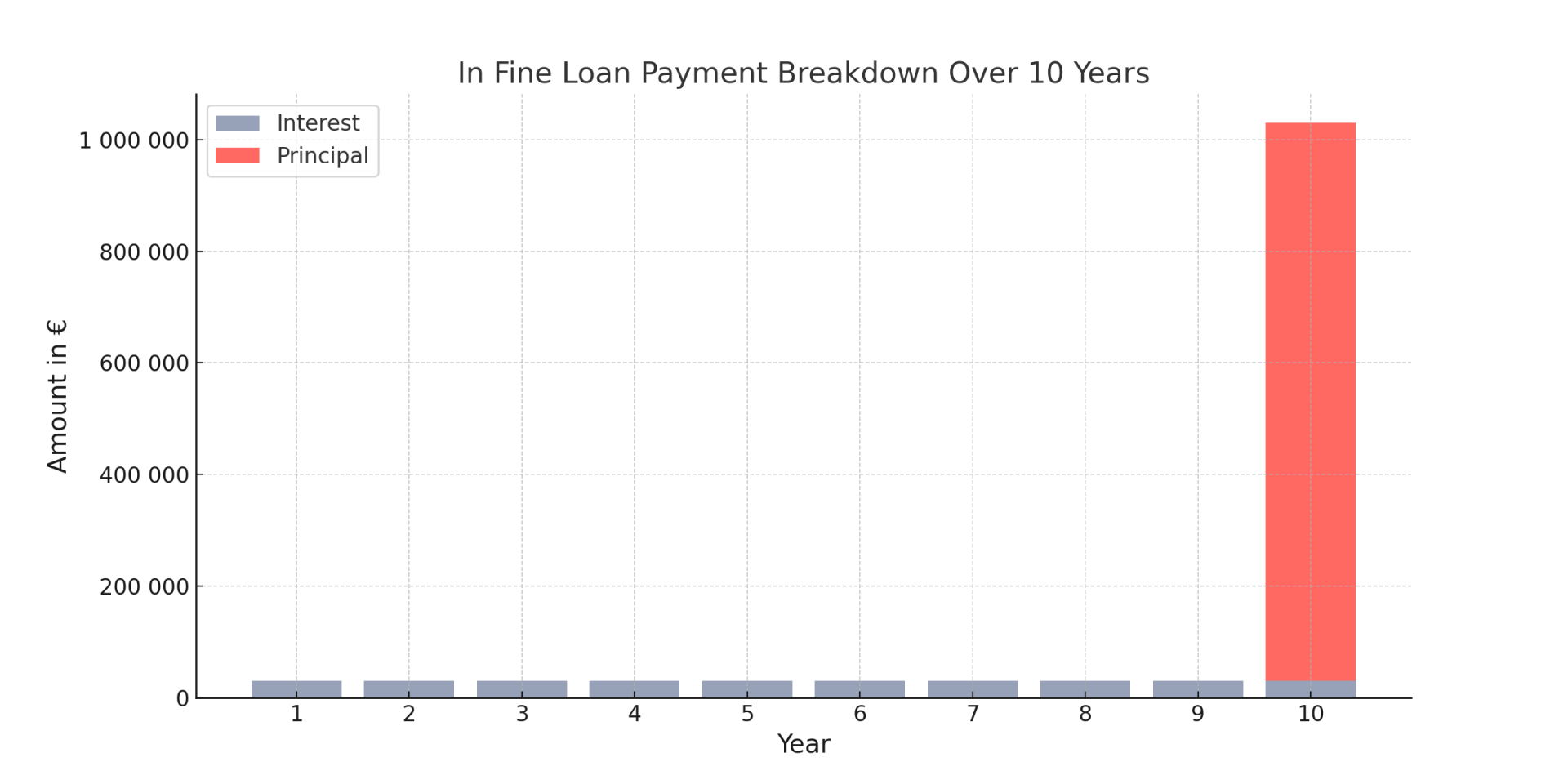

In Fine Loan (Prêt In Fine)

The borrower pays a fixed amount of interest annually, which is 3% of the loan amount, equating to €30,000 each year. This interest payment does not change over the loan term since the principal is not being paid down during the term. Instead, the full loan principal of €1,000,000 is repaid at the end of the 10th year.

By the end of the loan term, the borrower would have paid a total of €300,000 in interest. When combined with the principal repayment, the total amount paid over the 10 years would be €1,300,000.

By the end of the loan term, the borrower would have paid a total of €300,000 in interest. When combined with the principal repayment, the total amount paid over the 10 years would be €1,300,000.

The chart shown illustrates the payment structure for an In Fine Loan. The interest payments, depicted in gray, remain consistent year over year, while the principal component, shown in red, is only paid at the end of the term.

This payment method results in a lower annual payment throughout the loan term but a larger lump sum payment at the end. It's a structure that might be preferred by investors who can utilize the annual interest payments as a tax deduction and who have a plan for repaying or refinancing the lump sum at the loan's maturity.

Preparing Your French Mortgage Application: Required Documents

Applying for a mortgage in France is a structured process, and having the right documents at hand is crucial. Below is a comprehensive list of the documents you will need to provide:

Personal Details

- Current passport: A valid passport as proof of identity.

- Certificate of family composition: An official document detailing the members of your household.

- Certificate of marriage/divorce (if applicable): Legal proof of your marital status, which can affect your application.

- Marriage contract (if applicable): If you have a prenuptial agreement or similar legal document.

- Certificate of residence or Proof of home address: A recent utility bill, council tax bill, or another official document to prove your residence.

Employment Details

- An employment contract: To verify your employment status and income.

- Last 3 months' pay slips: These provide a snapshot of your current earnings.

Taxation Details

- Last 2 P60’s or tax returns: Essential for showing your historical income and tax contributions.

Self-employed Documentation (if applicable)

- Identification number of the entrepreneur: Your unique tax or business identification number.

- Statute, business card, professional card: Documentation that proves your business status and operations.

- The last 3 years' accounts for the company: To demonstrate the financial health of your business.

- Certified accountant’s letter stating income for the last 2 years: An accountant’s verification of your earnings.

Property Documentation

- Documents on the ownership of property: Legal papers confirming your property ownership.

- The property’s value assessed and verified by the notary: A notary's assessment can be crucial in the mortgage process.

- Notice of tax on housing payment: To indicate your current property tax obligations.

- Sale and Purchase agreement on property (compromis de vente, contrat de réservation): Preliminary contracts that initiate the property buying process.

Financial Details

- Bank statements for the last three months: To provide a recent overview of your financial activity.

- Statement of assets: A comprehensive list of your assets, which can affect your borrowing capacity.

- Current rental agreement (if that is your current accommodation): To verify your current living expenses.

- Proof of any extra income: Such as tax returns showing rental income, pensions, and dividends.

- Proof of the origin of your personal contribution: Documentation for your down payment sources, like savings accounts or bonds.

- The settlement table for the repayment of all current loans: To outline your existing financial commitments.

- Bank details: For the mortgage provider to establish a direct line to your finances.

The standard documentation for a French mortgage is broadly applicable, catering to French nationals, EU citizens, and non-EU residents. Each group, however, might encounter specific variations in the documentation requirements. French nationals generally face a simpler process, given their financial history within the French system. EU citizens, while generally finding the process straightforward due to EU agreements, may need to submit extra financial documents from their home countries. Non-EU residents typically undergo more rigorous checks and are often required to provide extensive proof of financial stability, including evidence of ties to France or the EU.

These guidelines can vary significantly based on the property's intended use, whether it be a primary residence or a rental investment, the type of property, and the specific mortgage product being applied for. For the most accurate and updated requirements, especially for expatriates and international clients who might encounter more complex scenarios in their French mortgage applications, a consultation with a lender or mortgage broker is crucial. Tools like a french property mortgage calculator are useful for initial estimations, and applicants should be prepared to supply additional documentation, such as proof of overseas income or assets.