Introduction

France ranks 32nd in the World Bank's ease of doing business report for 2021, making it a viable destination for international entrepreneurs and investors. Particularly in Côte d'Azur, the region has an undeniable allure, offering a unique blend of lifestyle and business prospects, ideal for a diverse range of activities including technology startups, hospitality ventures, and luxury real estate investments.

Setting Up a Legal Entity: Understanding Types of Business Structures in France

When embarking on a business venture in France, choosing the right legal structure is pivotal. This selection not only impacts taxation but also managerial flexibility and risk liability. France provides a rich array of business structures.

Limited Liability Company (SARL, Société à responsabilité limitée)

The SARL is an adaptable option, well-suited for small to medium-sized businesses. It allows for 1 to 100 shareholders, providing a balance between flexibility and structure. Shareholders' personal assets are protected against business debts, offering limited liability. This entity type is favored for its straightforward governance and operational simplicity.

Simplified Joint Stock Company (SAS, Société par actions simplifiée)

Known for its operational flexibility, the SAS is ideal for businesses expecting rapid growth or with complex shareholding patterns. There's no minimum capital requirement, and it offers a streamlined process for transferring shares. The SAS appeals to venture capitalists and serves as a suitable model for companies aiming to scale up or go public.

Joint Stock Company (SA, Société Anonyme)

The SA caters to larger corporations, being the only form that can be listed on the stock exchange. It requires at least seven shareholders and a minimum capital of €37,000. The SA has a more regulated governance structure, including a board of directors and mandatory shareholder meetings, making it suitable for businesses seeking a robust corporate framework.

Micro-entrepreneur (Auto-Entrepreneur)

This structure is designed for solo entrepreneurs and individuals looking to run small-scale ventures. It is particularly beneficial for its minimal administrative requirements and streamlined taxation process. The Micro-entrepreneur status is ideal for those focusing on operational aspects rather than complex administrative tasks.

Registration Process

Chamber of Commerce Registration

The Chamber of Commerce serves as the primary authority for the registration of most business types in France, including SARLs, SASs, and SAs. Upon submitting the necessary documents, the Chamber provides a K-bis extract, which is the official company registration certificate. This document serves as the identification of the business and is often required for various formalities such as opening a bank account.

Certain professional sectors, however, are exempt from Chamber of Commerce registration. Liberal professions like medical practitioners, legal consultants, and architects typically register through their respective professional bodies. It is crucial to determine the appropriate registering authority for your business type to ensure compliance with regulatory norms.

SIREN Number

Regardless of the business structure—be it an SARL, SAS, SA, or Micro-entrepreneur—a SIREN number is mandatory. This 9-digit unique identification number is assigned at the time of business registration and is crucial for tax identification and administrative procedures. Keep this number securely, as it will be referenced in all interactions with French administrations, both fiscal and social.

Business Bank Account

Opening a business bank account is mandatory for all types of business structures in France. It is especially relevant for SARLs and SAs, where the minimum share capital must be deposited in a blocked account until the company is officially registered. The bank account should be in the name of the business and will serve as the primary channel for all business-related financial transactions.

For Micro-entrepreneurs, the requirement is slightly more lenient; while a separate bank account is recommended for better financial management, it is not a strict requirement until the business reaches a specific turnover.

Expect the account activation process to take approximately 15-20 working days, although this may vary depending on the bank and the completeness of the submitted documentation.

Entity-Related Taxes: Understanding Business Tax Obligations by Entity Type

The two major types of taxes that affect businesses, regardless of their legal structure, are Corporate Tax and Value-Added Tax (VAT). However, the implications of these taxes can vary depending on the type of business entity.

Corporate Tax (Impôt sur les Sociétés, IS)

- Société à Responsabilité Limitée (SARL): SARLs with a turnover of less than €10 million can qualify for a reduced corporate tax rate of 15% on profits up to €42,500. Above this threshold, the standard rate of 25% applies.

- Société Anonyme (SA): These companies are subject to the standard corporate tax rate of 25%. However, for companies with a turnover exceeding €250 million, the rate is 28% on profits up to €500,000 and 31% for profits above this amount.

- Société par Actions Simplifiée (SAS): Similar to SAs, SAS companies are subject to the standard corporate tax rate of 25%, regardless of their profits.

- Micro-entrepreneur: Not subject to corporate tax. Instead, they pay income tax on business profits, with a flat-rate reduction of 34% applied to their turnover under micro-BNC arrangements.

VAT (Value-Added Tax)

- All Entities: The standard rate is 20%. Reduced rates of 10% and 5.5% apply to specific goods and services. The 10% rate applies to passenger transport, catering, home improvement, accommodation, and hotels, while the 5.5% rate is for certain food categories and books.

- Micro-entrepreneurs: They are exempt from VAT if their turnover is less than €36,800 for services or less than €91,900 for trade and accommodation activities.

Real Estate-Related Taxes: Key Implications for Businesses

-

Property Tax (Taxe Foncière): This is an annual tax levied on the ownership of property, applicable to all types of business entities that own real estate. The rate varies depending on factors such as the property's location and type, typically ranging between 0.5% to 1.2% in the Côte d'Azur area. It's important for businesses to consider these local variations when budgeting for property-related expenses.

-

Business Premises Contribution (Contribution Foncière des Entreprises, CFE): This annual tax is based on the rental value of business premises and varies by municipality. The rate is influenced by factors such as the business's annual revenue and local municipal policies. All business entities, including micro-entrepreneurs (albeit at a reduced rate), are subject to this tax.

-

Real Estate Wealth Tax (Impôt sur la Fortune Immobilière, IFI): Applicable to individuals owning real estate assets exceeding a value of €1.3 million, this tax has significant implications for high-value property owners. Businesses holding substantial real estate assets should be aware of this threshold to manage their fiscal obligations effectively.

-

Stamp Duty Land Tax: Levied on the transfer of property ownership, this tax is applicable in various scenarios, including property sales, inheritance, or donations. The rates and calculations for this tax can vary, and it's crucial for businesses to understand these details, especially during property transactions.

-

Local Rates (Taxe d'Habitation): Generally a residential tax, this can also apply to mixed-use properties. With the ongoing phase-out for primary residences, businesses with residential components should consider how this evolving tax landscape might affect them.

-

Real Estate Capital Gains Tax: This tax is applied to the profit from the sale of property assets. Conditions such as the length of property ownership influence its application, and there are potential exemptions or reductions based on ownership duration. Understanding these nuances is vital for businesses planning to sell property assets.

-

VAT on Property Transactions: For activities like construction, renovation, or significant property modifications, different VAT rates and conditions apply. Businesses in these areas should be aware of the applicable VAT implications.

-

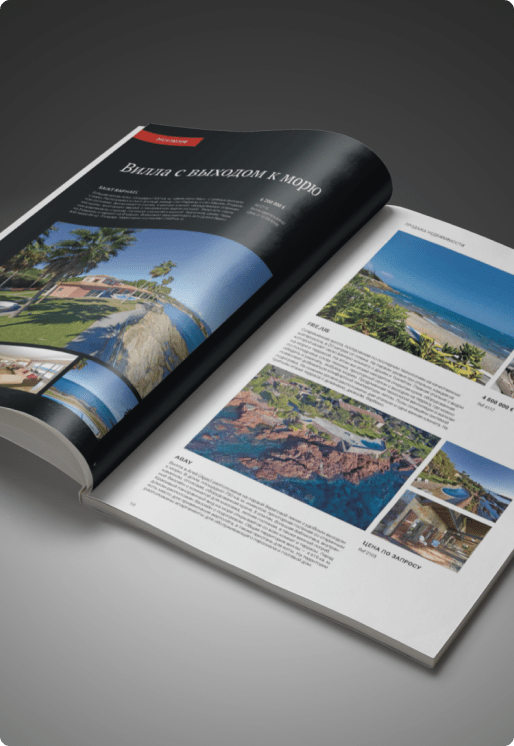

Regional Implications in the Côte d'Azur: In this region, property values and related taxes are often higher than the national average due to its desirability. Businesses operating here should factor in these regional specifics when considering real estate investments and related tax obligations.

By comprehensively understanding these taxes and their nuanced implications based on business structure and location, companies can more effectively navigate their fiscal responsibilities while optimizing operational efficiency in the real estate sector.

Regulatory Framework

Commercial Code

In France, businesses must navigate a robust regulatory environment, starting with the Commercial Code (Code de Commerce). This comprehensive legal framework outlines the rules for trade, company formation, and commercial transactions. It also sets forth the responsibilities and obligations of business owners, including contractual obligations, company management, and insolvency proceedings.

Compliance and Licenses

Compliance with local laws and regulations is critical, particularly in sectors like hospitality, where specific licenses are mandated. For example, businesses serving alcohol require a License IV, which authorizes the sale of alcoholic beverages for consumption on or off the premises. Obtaining this license involves a regulatory process, including training in the responsible service of alcohol and an understanding of the legal implications surrounding its sale.

Real Estate Regulations

The luxury real estate market in the Côte d'Azur operates under a distinct set of zoning laws, vital for investors and developers to understand. Properties are classified into zones such as "zone constructible" (buildable) or "zone non-constructible" (non-buildable), with each classification impacting a property's potential uses and market value. In buildable zones, development is generally permitted, subject to compliance with local urban planning regulations. These might include restrictions on the size, height, or architectural style of buildings. In contrast, non-buildable zones are often designated for environmental protection or agricultural use, and development is typically restricted.

Moreover, the Plan Local d'Urbanisme (PLU) plays a pivotal role in shaping the real estate landscape. This local urban planning document outlines the rules and guidelines for land use in a specific municipality. It provides detailed information on where residential, commercial, or industrial developments can be located, as well as the preservation of green spaces and historical areas. Understanding the PLU is crucial for any real estate venture, as it can significantly impact project feasibility and compliance.

Environmental Compliance

Environmental regulations also play a significant role, especially in sensitive areas like the Côte d'Azur. Developers must adhere to environmental standards, including impact assessments and measures to protect local ecosystems. These regulations aim to balance development with the preservation of the region's natural beauty and biodiversity.

Business Visas and Immigration

In terms of business visas and immigration, France offers several options tailored to professionals with different needs and qualifications. The Talent Passport is a multi-year residence permit aimed at highly skilled professionals in specialized fields such as technology, engineering, and finance. This permit offers not just a residence advantage but also facilitates access to the French job market. On the other hand, the Long-Stay Visa is more apt for individuals contemplating long-term business projects in France. This visa category allows for an extended stay of up to one year and is renewable, thus providing ample time for substantial business undertakings. Both visa types aim to accommodate different professional needs, ensuring that France remains an attractive destination for global talent and business ventures.

Navigating Local Business Culture

In the Côte d'Azur, business culture harmonizes formal protocols with the importance of relationship-building. While punctuality, professional attire, and careful handling of official documents are fundamental, the region places significant emphasis on nurturing personal connections. This duality is evident in numerous networking events often organized by local and international chambers of commerce, offering invaluable opportunities to forge meaningful business relationships. Thus, a nuanced understanding of this unique blend of formality and interpersonal engagement is essential for long-term success in the Côte d'Azur's cosmopolitan business environment.

Conclusion

Navigating the business landscape in Côte d'Azur offers a unique blend of lifestyle and financial opportunities. With a strong legal framework, multiple business structures, and a diverse set of industries ripe for investment, the region serves as a compelling destination for a wide array of international business professionals.