What Owners and Tenants Need to Know

Purchasing or renting property in France is almost always accompanied by questions relating to insurance. For foreign buyers and tenants, the French insurance system may initially seem unfamiliar; however, in practice, it is designed to protect not only the property itself, but also the owner or occupant against potentially very serious financial risks.

In France, property insurance is neither a mere formality nor a simple “box to tick” for contractual purposes. It is a comprehensive financial protection tool, without which a single incident can result in costs amounting to tens or even hundreds of thousands of euros.

What Is Home Insurance in France

The principal form of property insurance in France is known as assurance multirisque habitation. This is a comprehensive policy that combines protection for the property itself, the contents within it, and the civil liability of the owner or occupant.

Unlike in many other countries, insurance in France is rarely limited to “walls only” or “furniture only.” In most cases, a single policy is taken out to cover several categories of risk simultaneously.

Such insurance generally includes cover against fire, water damage, explosions, storms, and other common domestic incidents. In addition, it provides insurance for personal belongings and—most importantly—civil liability towards neighbours and third parties.

Civil liability is the cornerstone of the French insurance system and is precisely the aspect most often underestimated by foreign property owners.

Is Property Insurance Mandatory by Law?

The answer to this question depends on who occupies the property.

For tenants, insurance is a legal requirement. Anyone renting an apartment or a house in France must take out an insurance policy and provide the owner each year with proof of cover in the form of an attestation d’assurance.

If the tenant fails to do so, the owner is entitled either to take out insurance on the tenant’s behalf and include the cost in the rent, or to terminate the lease agreement.

As a general rule, the minimum level of cover required for tenants includes protection against fire, water damage, and explosion, as well as civil liability.

What About Property Owners?

From a legal standpoint, the situation for property owners may appear more flexible, but only at first glance.

If the apartment is located in a shared building under the copropriété regime, the owner is legally required to hold at least civil liability insurance. This is a direct requirement under French law.

In the case of a private house, or an apartment occupied by the owner and not rented out, insurance is not always strictly mandatory from a formal legal perspective.

However, in practice, the absence of insurance in such circumstances represents an extremely serious financial risk.

Why Property Owners Should Never Remain Uninsured

In France, a property owner bears full financial responsibility for any damage their property may cause to others.

A simple water leak can affect several floors below. A fire may spread to neighbouring apartments or to the common areas of a building. Even a minor incident can sometimes result in very substantial repair costs.

In such situations, the amounts involved are often not limited to a few thousand euros, but can easily reach tens or even hundreds of thousands.

Special consideration must also be given to the French system for recognising natural disasters. Floods, droughts, landslides and similar events are compensated by the state only if the owner holds a valid insurance policy. Without insurance, obtaining meaningful compensation is impossible.

Finally, when a property is purchased with a mortgage, insurance is a mandatory requirement imposed by the bank for the entire duration of the loan. In practice, this means that the vast majority of properties in France are insured.

Who and what exactly should be insured

-

A tenant is responsible for insuring the property they occupy and their civil liability.

-

An owner who rents out their property typically takes out a separate policy known as propriétaire non occupant—insurance for the owner who does not reside in the apartment or house.

-

An owner living in their own property takes out a standard assurance multirisque habitation policy.

-

It is important to note that in a multi-unit building, the structure of the building is insured by the managing company (syndic), but this insurance only covers the building itself and the common areas. It never replaces the personal insurance of the owner or tenant.

What a Standard Policy Typically Covers

A standard insurance policy covers the structural elements of the property, such as walls, floors, ceilings, and built-in fixtures, as well as furniture, household appliances, and personal belongings.

A separate and critically important component of the policy is civil liability. This coverage comes into effect in cases where damage is caused to neighbours or third parties.

What Is Not Automatically Covered

High-value items—such as jewelry, luxury watches, artworks, or collections—almost always require separate declaration or additional insurance coverage.

Without this, the insurance company may either significantly limit the compensation or refuse it entirely.

An Important Point: Valuing Your Belongings

In the French insurance system, it is the owner or tenant who declares the value of their personal property.

If this value is underestimated, the insurance company has the right to reduce compensation proportionally. If it is significantly overestimated, the policyholder simply pays higher premiums each year.

For this reason, it is essential to provide a realistic valuation and, whenever possible, keep receipts and photographs of the interior and valuable items.

Cost Of Insurance

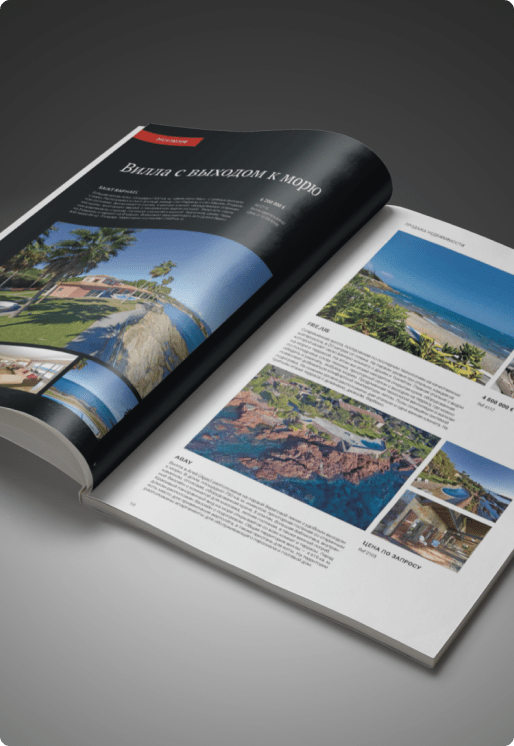

The cost of insurance depends on factors such as the property’s size, location, level of risk, value of belongings, and the policyholder’s claims history.

On average, insuring an apartment costs a few hundred euros per year. Houses or villas are more expensive, particularly in prestigious or high-tourist areas.

Specific Considerations for Southern France and the French Riviera

In this region, insurance companies pay particular attention to risks such as flooding, wildfires, storms, and theft during periods when owners are away.

Additional requirements may sometimes be imposed to protect the property, such as the installation of shutters or security alarms.

Conclusion

For tenants, home insurance is mandatory.

For property owners, it is not always strictly required by law, but in practice it is an essential aspect of financial security.

The French civil liability system is structured in such a way that a single serious incident without insurance can result in extremely severe financial consequences.